A New Standard for Cross-Chain Infrastructure

For more than a decade, networks have multiplied faster than capital could keep up with them.

Every new network promised lower transaction costs, faster settlement, and new financial primitives. And every time a new chain gained traction, the same problem appeared almost immediately: liquidity fragmented, users had to manually shuttle assets around, and issuers were forced to maintain operational complexity just to remain present across ecosystems.

But as the ecosystem matured, it became increasingly clear that transport alone was not enough.

Cross-chain could move assets, but capital still did not function as a unified system.

This is the gap Enso has been closing from day one, turning cross-chain transport into deterministic execution through programmable, outcome-driven workflows.

And now, Enso is expanding that execution layer even further.

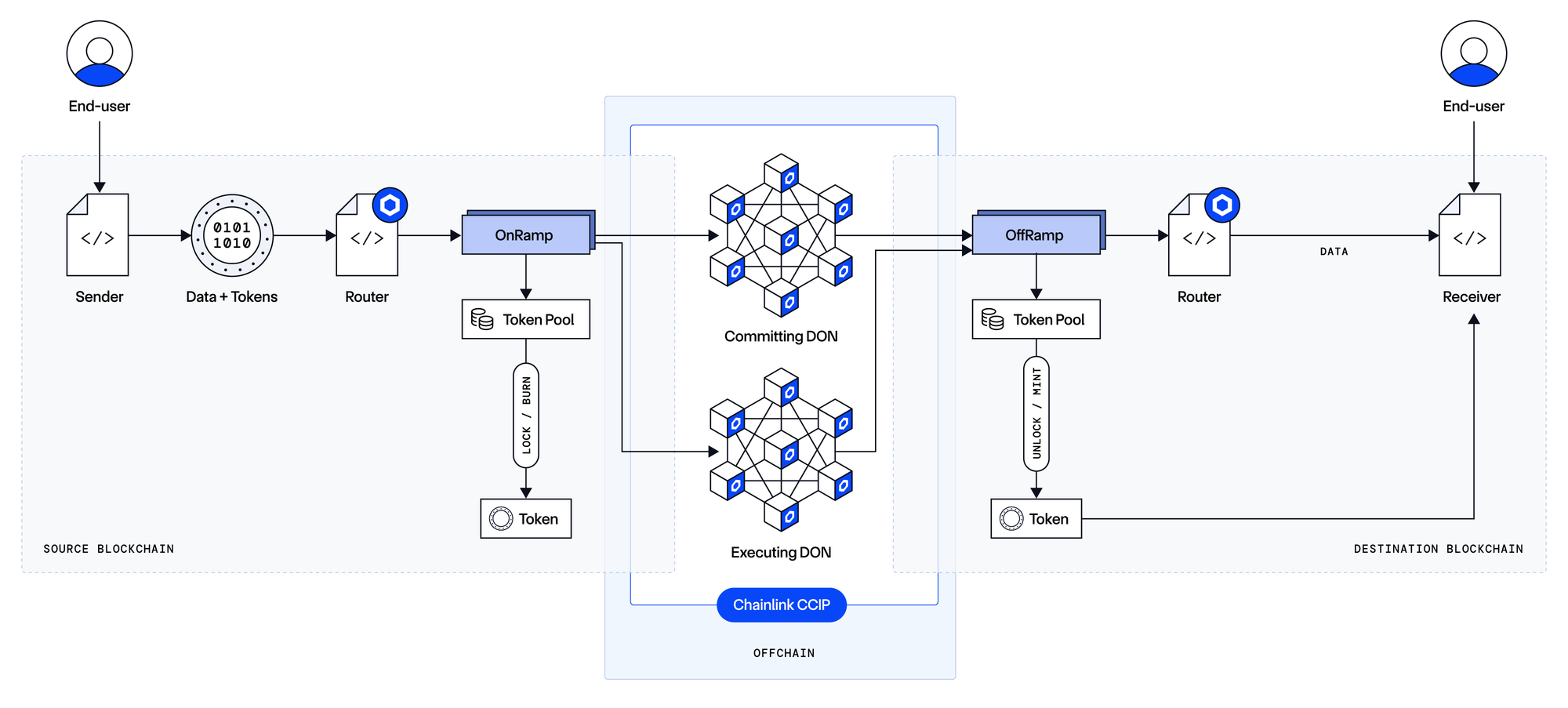

With live production deployments powered by Chainlink CCIP, alongside Enso’s existing cross-chain infrastructure, capital can move across ecosystems and arrive already deployed into real operations in a single atomic flow.

Rather than simply transferring assets between chains, Enso now coordinates full cross-chain execution: minting, routing, swapping, deploying to liquidity, and automatically entering strategies on arrival.

Real Infrastructure for Mass Adoption

This shift is already live in production, with asset issuers and protocol teams building at scale, including Reservoir.

When large issuers and strategy platforms operate across multiple chains, reliability is not optional. Execution needs to be pre-simulated, atomic, and guaranteed. Fragmented multi-step transactions simply do not scale when millions of dollars are involved.

Deterministic execution turns cross-chain activity into infrastructure institutions can rely on.

How it works under the hood

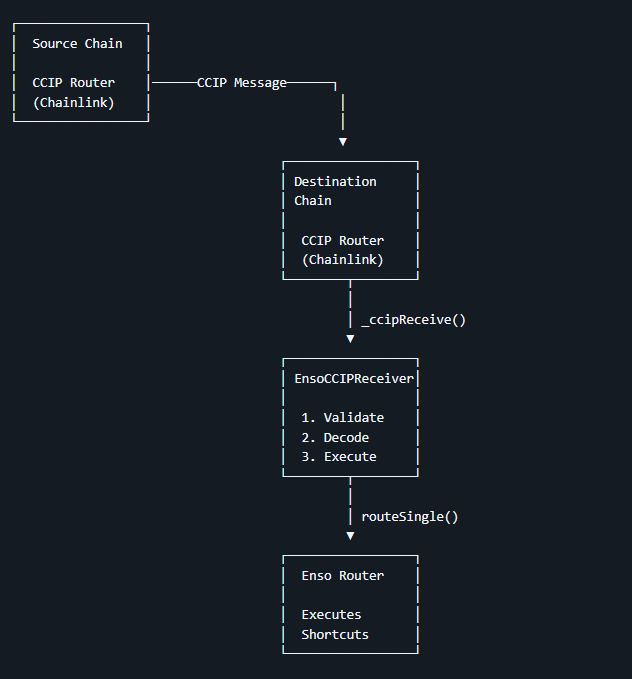

At the core of the integration sits the Enso CCIP Receiver, a destination-side smart contract that connects Enso’s execution engine directly with Chainlink CCIP, allowing cross-chain messages carrying ERC-20 tokens to trigger fully deterministic Enso Shortcuts workflows on arrival.

Tokens are sent from a source chain via CCIP, received alongside execution payloads on the destination chain, and immediately routed through Enso’s composable multi-protocol operations in a single atomic transaction.

These contracts have been fully audited: https://github.com/EnsoBuild/enso-audits/blob/main/reports/dedaub/Dedaub_EnsoCCIPReceiver_v_1_0.pdf

Unlocking Scalable Cross-Chain Finance

One of the most powerful outcomes of this model is capital efficiency.

Historically, expanding a stablecoin or asset across ecosystems required pre-funding liquidity pools in each ecosystem. Capital sat idle across dozens of networks simply to ensure users could access it.

With deterministic execution, issuers can adopt hub-and-spoke models that mirror traditional financial systems. Assets can be minted on a primary chain and deployed across ecosystems only when demand exists. Liquidity stays concentrated. Operations remain clean. Expansion becomes scalable instead of fragile.

For stablecoins, yield-bearing assets, and treasury products, this represents a fundamental improvement in how cross-chain finance operates.

By uniting secure cross-chain messaging with deterministic, simulation-backed workflows, Enso and Chainlink are establishing a new standard for how capital operates across networks.

As decentralized finance grows into a global financial system, infrastructure must support not just movement, but coordinated execution at scale.