Automating Asset Management with Enso Shortcuts

Onchain asset management is exploding, but execution remains the bottleneck.

Users want clean interfaces and instant access to their vaults. Builders get stuck wrestling with backend complexity: swaps, approvals, zaps, routing, bridging, rebalancing. Every new strategy demands more code, more integrations, more opportunities for failure.

Enso changes the game.

Enso powers the execution engine behind asset management protocols. We handle the heavy lifting so teams can focus on what matters: product design, strategy logic, and user experience. From token conversion to vault entry, from routing to rebalancing, Enso Shortcuts make complex multi-step flows simple, modular, and bulletproof.

Clean UX, Zero Execution Burden

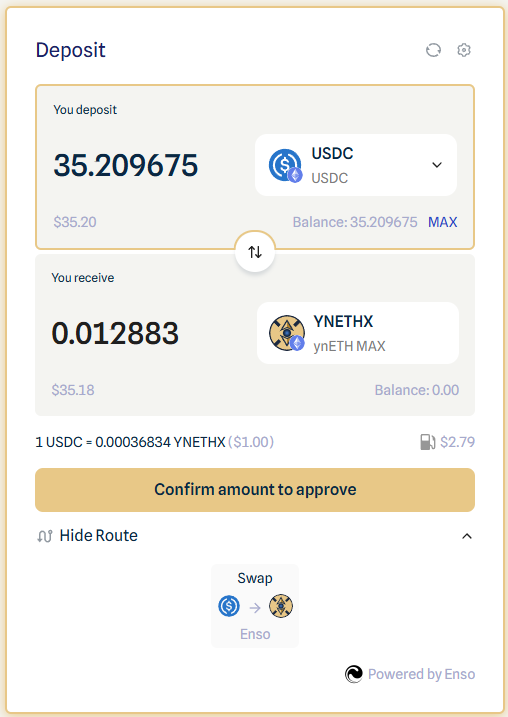

Vault protocols often ask users to deposit a single token, but underneath that requires multiple actions: swap to base asset, vault deposit, allocation across layers. Most teams either build this themselves or patch together brittle adapters and custom code.

With Enso, protocols skip the execution stack entirely. One Shortcut handles the full flow, deposit to allocation, abstracting token approvals, routing, and protocol interactions in a single atomic transaction.

Projects like Yearn, Vaultcraft, YieldNest, and Velvet Capital use Enso to power these flows. Their UI stays simple. Enso ensures user funds route correctly, efficiently, and securely into the intended strategy.

Zaps and Swaps: Solved

Asset managers want to accept any input token and streamline deposits into unified strategies. That means managing zap logic, swap routing, token approvals, and cross-chain bridging.

Enso abstracts this entire layer.

The user deposits any supported token. Enso handles the swap to the correct asset, approves necessary contracts, and executes the entry. All in one transaction. Protocols define the destination. Enso handles getting there.

Teams like Yearn offer flexible entry points for their products without bloating codebases or rebuilding backend mechanics for every new vault.

Rebalancing and Auto-Compounding

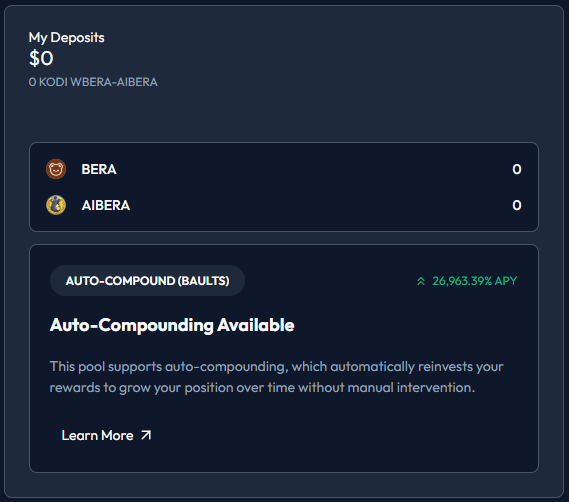

Rebalancing drives asset management products, but implementing it is rarely straightforward. Each rebalance involves swapping between assets, exiting and re-entering vaults, adjusting allocation weights. Manual execution or hardcoded logic creates bottlenecks and errors.

Enso makes rebalancing programmable.

Protocols like Kodiak rely on Enso Shortcuts to power their auto-compounding bots, enabling seamless reward token sales and reinvestments with optimal execution. By abstracting the complexity of multi-step strategies, Enso ensures Kodiak can compound yields efficiently into the desired pools. If you're curious about the specifics, you can dive into their documentation for a closer look.

This gives builders the confidence to iterate on strategies, react to market conditions, and rapidly evolve products.

The Invisible Engine

Users don't see Enso. They don't need to. They see vaults that work: enter with any token, deposit in one click, start earning yield.

They're experiencing backend orchestration powered by Enso.

We turn multi-step strategy entries into single transactions. We let builders support any token without managing dozens of swap paths. We power the flexibility, speed, and reliability of top asset management protocols without making stacks harder to maintain.

Next up: we’ll break down how Enso powers complex backend ops across protocols like Contango, BeraBorrow, Euler and more.

Until then, explore the docs → https://docs.enso.build/home