Enso Powered DeFAI

Autonomous agents, smart wallets, and AI-driven execution layers are taking shape across the ecosystem. But intelligence alone isn't enough. To be useful in Web3, agents must be able to take action onchain.

Enso provides the execution infrastructure for AI-native applications. Agents that use Enso can interact with protocols directly: swapping tokens, reallocating portfolios, entering yield vaults, and responding to market signals, all through modular, composable Shortcuts. These Shortcuts represent entire onchain flows condensed into a single transaction, bridging the gap between AI's logic and Web3's backend.

From Reasoning to Results

AI agents excel at analysis. They can read data, track wallet behavior, compare APYs, and decide how to optimize a position. But none of that matters unless those decisions result in action: real transactions that move value and change onchain state.

Enso provides the execution layer. The agent might decide, "Rebalance into ETH and deposit into a vault," and Enso handles the full execution path: identifying the optimal route, swapping tokens, applying approvals, and depositing into the protocol.

Apps like Wayfinder, Brahma.fi or Virtuals use this model to connect reasoning with results. Their agents execute vault entries, stablecoin reallocation, and position management flows through Enso in production.

Real-Time Execution

Markets shift. Rates change. New opportunities open and close quickly. A human can't manage this manually at scale, but an AI agent can, if it has reliable execution behind it.

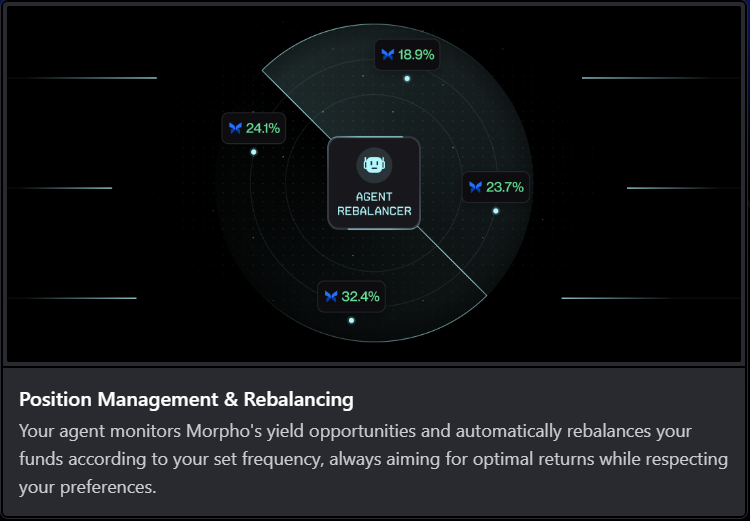

When a strategy changes or a threshold is triggered, an agent can immediately act: migrating funds, shifting assets, re-entering vaults, or exiting positions. Every move happens through Enso's Shortcuts, which are executed atomically and optimized for gas and routing.

This is how Brahma and Loomlay operate AI asset managers that dynamically allocate capital. Their backend doesn't rely on hardcoded paths or siloed integrations. Instead, agents express goals, and Enso executes the necessary logic across protocols.

Composability at the Infrastructure Layer

AI systems work best when they're modular. The same applies to onchain execution. Enso's composability enables agents to interact with over 170 protocols across chains using a unified framework.

That means an agent can be built once and deployed across multiple strategies, ecosystems, and use cases without needing to rewrite smart contracts for every action.

Enso is already powering the early wave of AI-native products. It's enabling tools that:

- Actively manage portfolios

- Rebalance between vaults

- Optimize yield strategies in real time

- Execute across chains and protocols without human intervention

But more importantly, it's unlocking new categories of applications that were previously too complex to execute.

Building What Comes Next

The onchain world is becoming more automated, customized, and intelligent. But without reliable execution, AI stays on the sidelines.

Enso brings it into the game, powering autonomous agents with the infrastructure they need to act onchain: securely, efficiently, and at scale.

Stay tuned, as tomorrow we dive right into asset and portfolio management.

If you feel like starting to build your own AI app, explore the docs: docs.enso.finance