Enso Powered DeFi Infra

The DeFi apps you use daily? Many run on Enso. The complex swaps, vault deposits, and stablecoin mints that just work? Enso powers them behind the scenes.

Building in DeFi used to mean solving the same puzzle over and over again. You want your users to swap, mint, or deposit? Wire up five protocols, handle token approvals, build routing logic, write zap flows, and maybe throw in a bridge. Every new feature becomes a stack of custom code and technical debt.

DeFi covers a wide range of applications. In this blog, we'll focus on 3 key aspects of DeFi: swaps, vaults, and stablecoins.

As the aggregation API powering DeFi, Enso handles the heavy lifting so teams can focus on their products. Whether it's a vault deposit, a stablecoin mint, or a complex swap, Enso turns multi-step logic into clean, reusable Shortcuts. These single-call executions handle routing, approvals, and orchestration, having enabled $15B+ in settlements on more than 75 protocols across the ecosystem.

The Infrastructure Behind Your Swaps

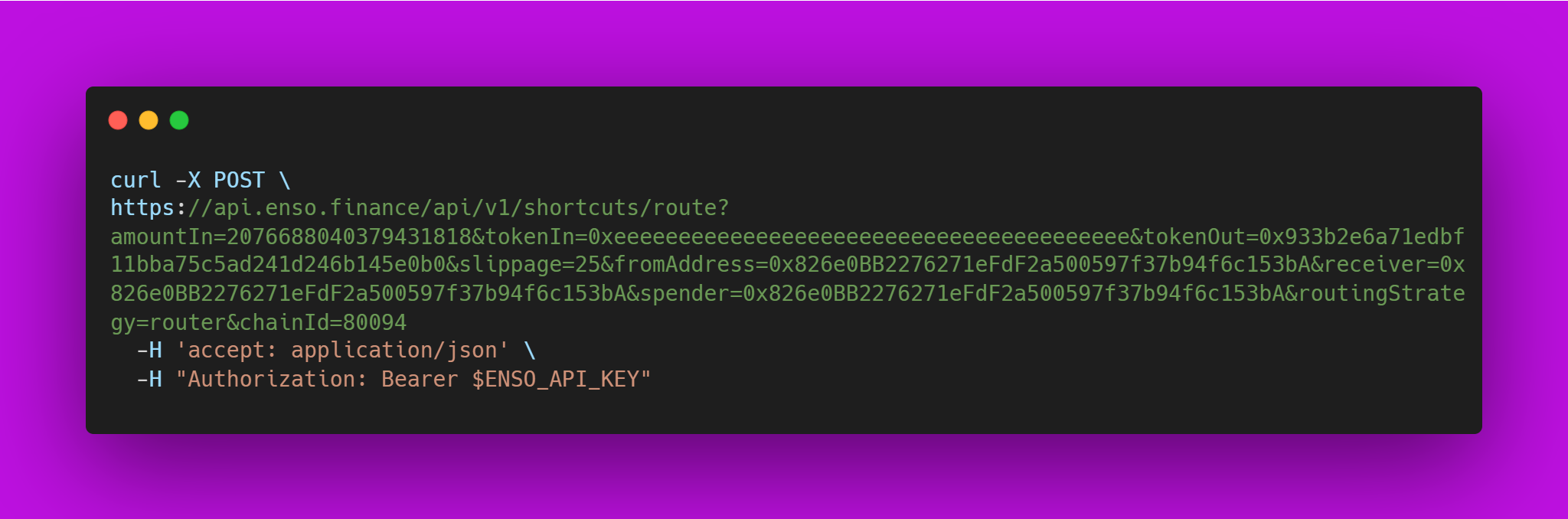

Every DeFi app needs swaps at some point. But beneath every swap lies routing decisions, liquidity sources, slippage protection just to name a few. Instead of building this infrastructure from scratch, projects build with Enso.

Developers specify what asset they want to swap from and to. Enso calculates optimal routes, handles approvals, executes transactions, and bridges between chains when needed. This is the infrastructure that powers apps like Kodiak on Berachain, delivering complex swap experiences through simple interfaces, as Enso handles the entire execution path.

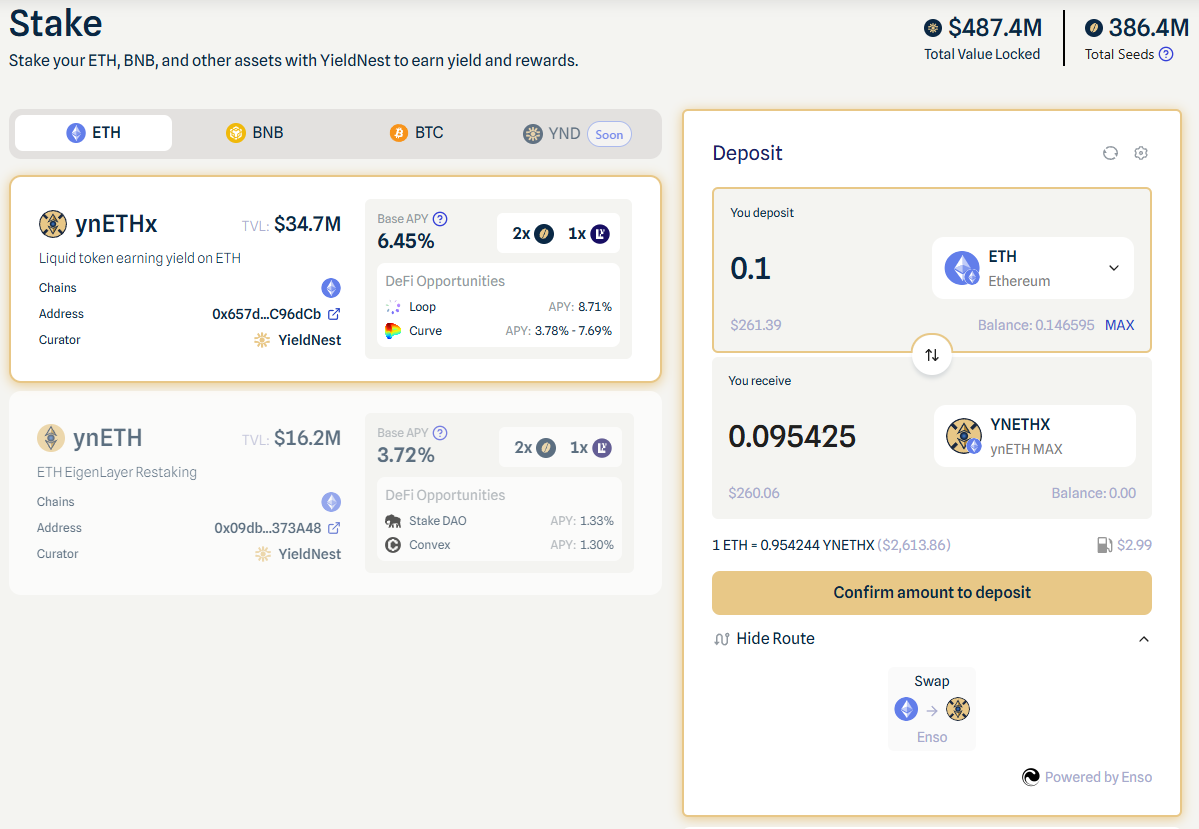

Vault Infrastructure Made Simple

Depositing into a vault used to require four different transactions: swap into the right asset, approve contracts, zap into LP tokens, then deposit into the vault. Each step could fail, get frontrun, or even lose funds.

Enso's API collapses this entire flow into a single Shortcut. Users sign once, everything happens atomically: asset conversion, approvals, deposits. For builders, vault access becomes plug-and-play infrastructure, regardless of the complexity of the vault logic. This powers projects like Stablejack and YieldNest, ensuring users can access structured yield products without complexity.

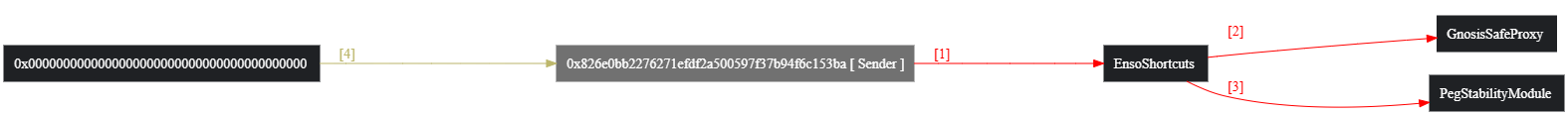

Stablecoin Infrastructure at Scale

Stablecoin protocols involve elaborate flows: convert asset A into collateral B, then mint stablecoin C. Exit flows run in reverse with redemption logic, fee accounting, and potential bridging.

Enso's API makes these flows programmable infrastructure. Builders define a mint Shortcut once, and it becomes universally accessible. Whether users start with ETH, stETH, or DAI, Enso finds the most efficient path into the collateral system, handles protocol-specific logic, and completes the mint in one call. Dinero, Level USD, and Reservoir rely on this infrastructure to onboard users efficiently.

Shortcuts powering DeFi

DeFi should be a modular, composable, programmable infrastructure. Not fragmented protocols requiring custom integrations for every feature.

With over 200 protocol integrations and trusted by projects across various use cases, including cross-chain swaps, AMMs, AI, and automation, Enso provides the foundational layer that makes DeFi actually work.

A new category drops tomorrow. Let’s just say… the agents are no longer just watching.

Are you ready to build? Start here: https://docs.enso.build/home