How HyperSwap Unlocked Multi-Chain Growth with Enterprise-Grade Execution

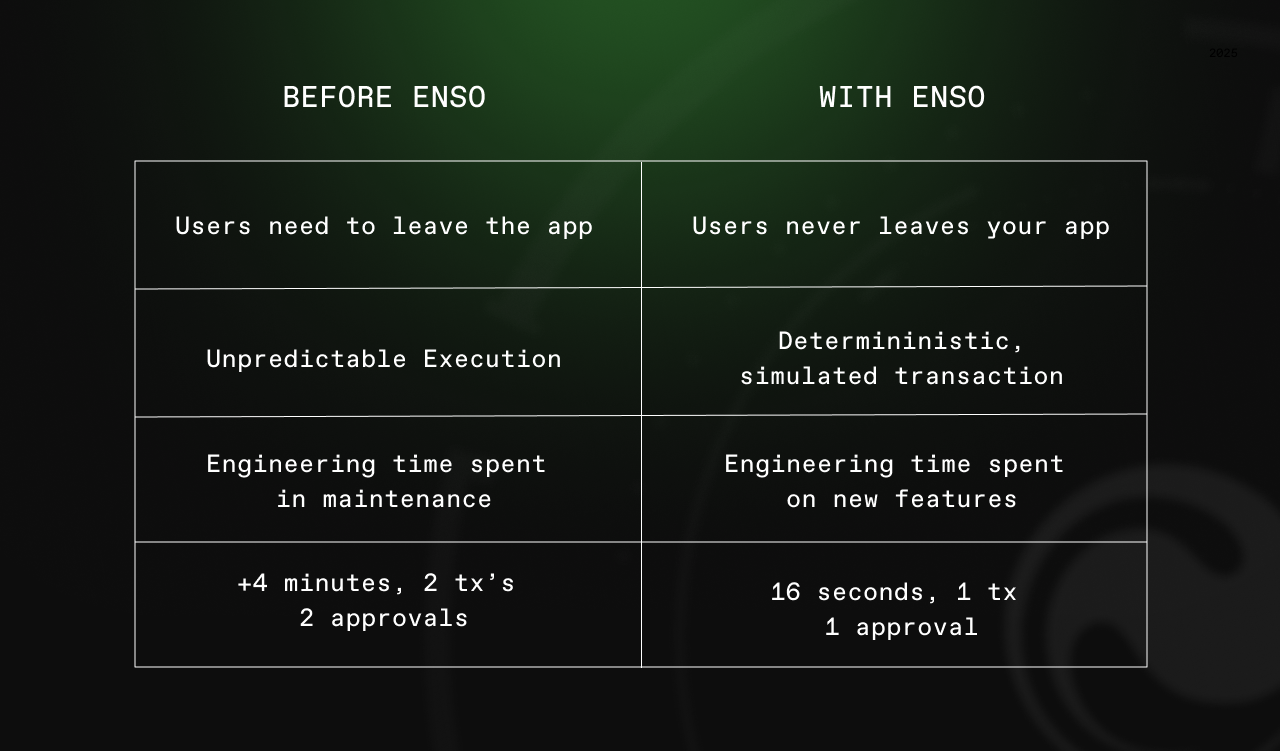

Launching on a new chain usually comes with a painful choice: spend months integrating liquidity, bridges, and routing systems, or launch without cross-chain swaps and watch users go elsewhere.

HyperSwap chose neither.

They shipped cross-chain swaps on HyperEVM by integrating Enso’s high-integrity execution, delivering reliable and consistent outcomes across chains.

What HyperSwap was really optimizing for wasn’t speed alone, but execution quality across chains, the foundation for sustainable multi-chain growth.

The Problem: Cross-Chain Complexity Eats Teams Alive

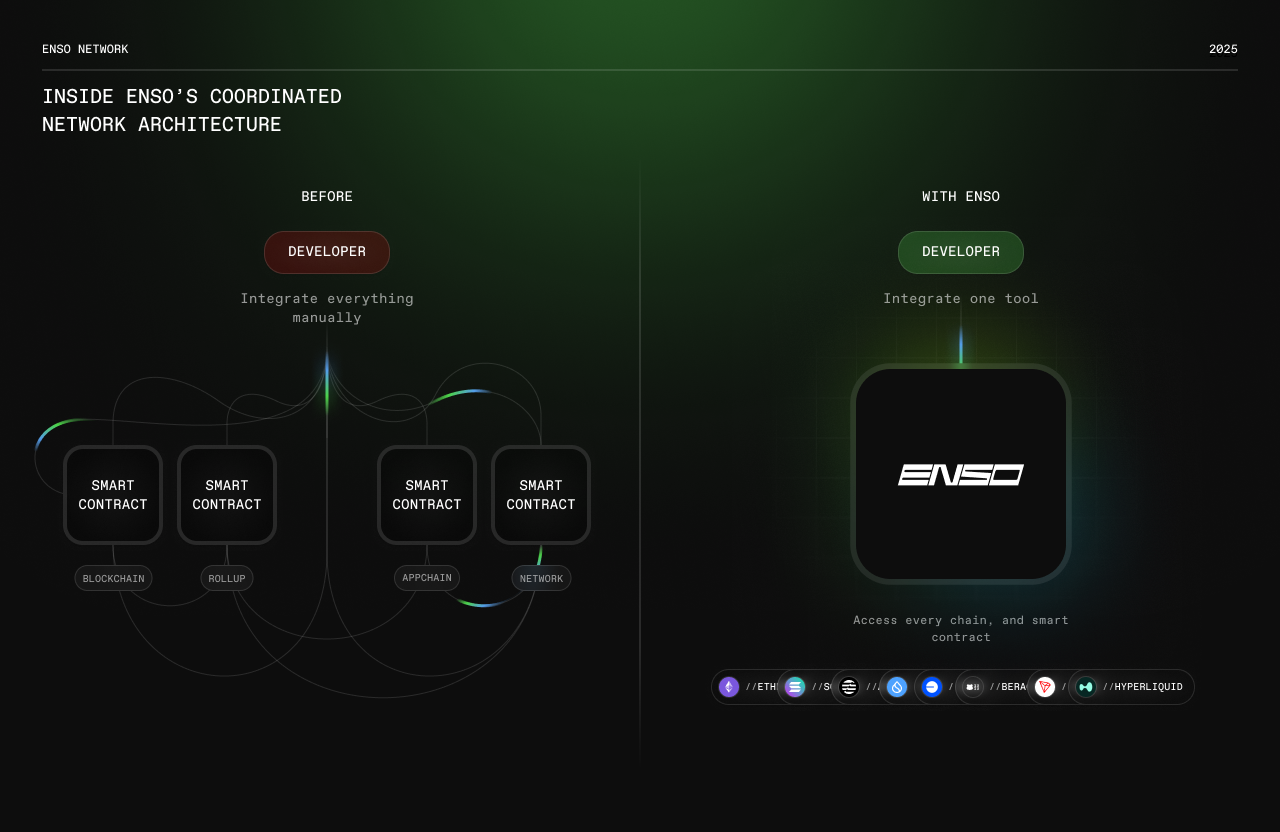

Building a cross-chain aggregator means integrating with dozens of DEXs, handling token approvals, maintaining token lists, managing bridges, tracking balances across chains, and updating contracts whenever anything changes.

It is slow, fragile, and infrastructure-heavy.

HyperSwap needed this solved on HyperEVM. For large users and serious liquidity, execution had to be reliable, transparent, and predictable from day one.

Other Providers Couldn't Deliver

Before choosing Enso, HyperSwap tested several cross-chain providers. Each had issues:

- Routes failed

- Pricing was inconsistent

- Bridges broke edge cases

- Token lists and balances had to be managed manually

“This quickly became heavy, fragile, and difficult to maintain.” https://x.com/0xRyzed, Hyperswap CEO

For HyperSwap, these weren’t just UX issues; they directly affected execution predictability and user trust, especially for high-value trades.

They needed something stable, flexible, and production-ready.

Why HyperSwap Chose Enso

After weeks of testing, Enso stood out immediately.

“The documentation is clear, the product is stable, and the routing quality is unmatched.” — https://x.com/0xRyzed, Hyperswap CEO

Three things changed the equation:

- Stability: predictable execution across chains.

- Responsiveness: real support from people who understand the infrastructure.

- Routing quality: better pricing and more reliable flows than any other provider.

More importantly, Enso offered deterministic, simulation-backed execution across chains, a requirement for confidently onboarding and retaining large, cross-chain users.

And the standout factor:

Execution integrity from day one, a prerequisite for retaining users and enabling HyperSwap’s multi-chain growth at scale.

What HyperSwap No Longer Needs to Build

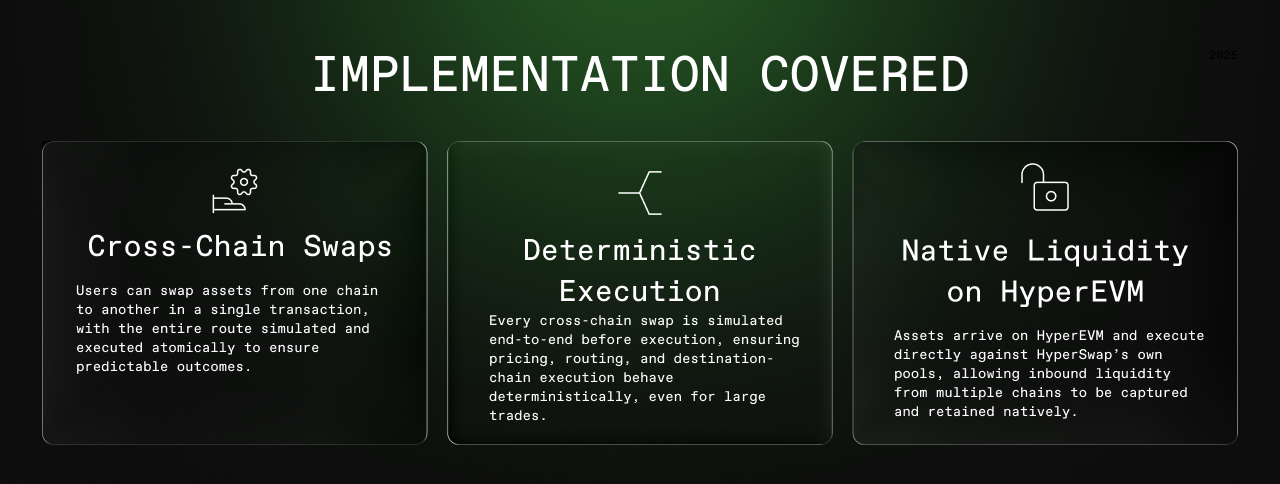

Enso replaced everything with a single API.

No token lists, no balance systems, no bridge logic, no routing algorithms, no multi-chain infra. Just one integration that worked out of the box.

This allowed HyperSwap to focus on execution guarantees rather than integration maintenance, a critical distinction for multi-chain liquidity and whale users.

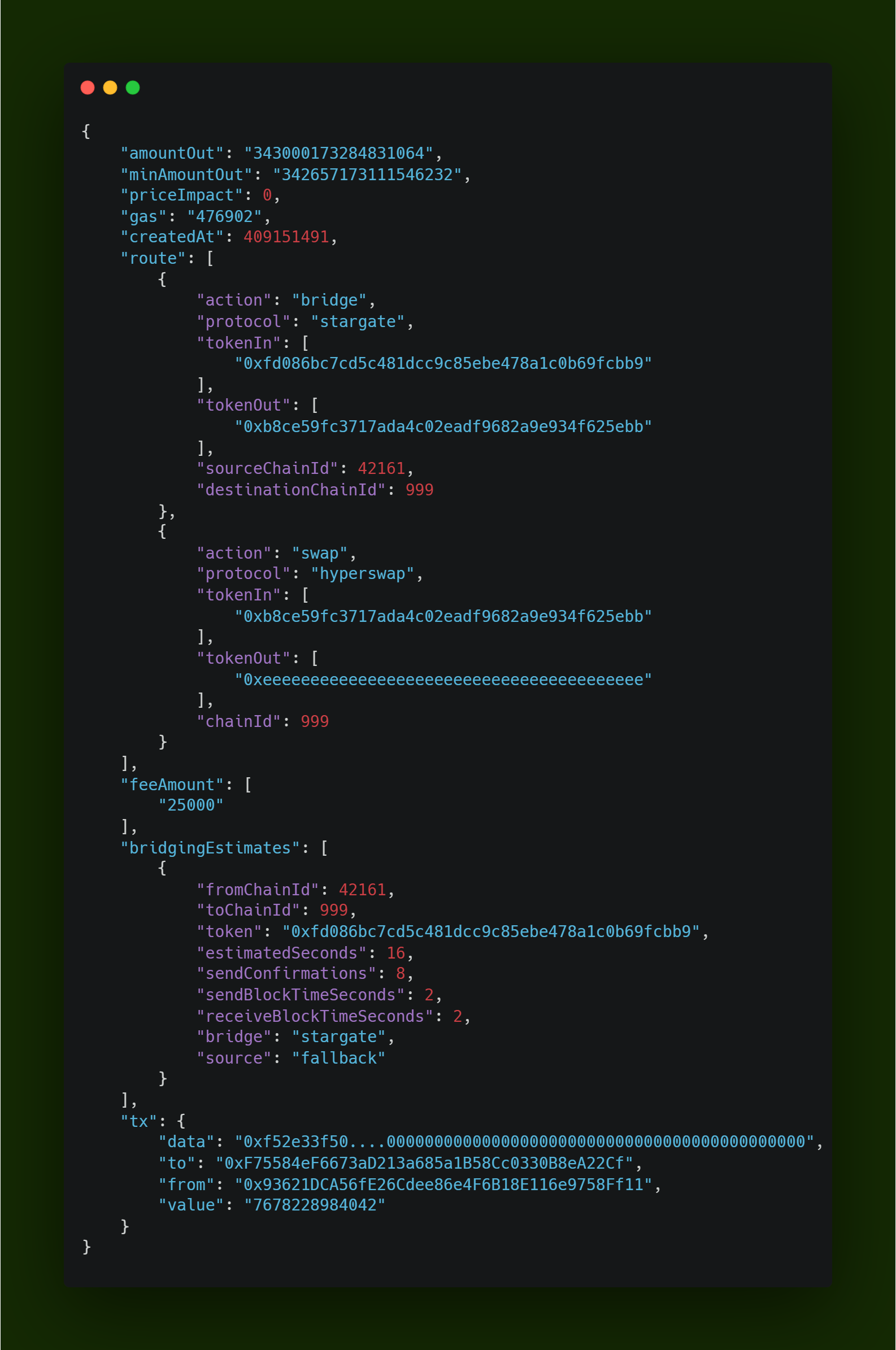

A Real Transaction: Arbitrum → HyperEVM

On December 8, 2025, a user submitted this transaction:

Swap 10 USDT on Arbitrum to HYPE on HyperEVM.

The user signed one transaction.

Enso handled the rest.

The entire route was simulated end-to-end before execution, ensuring pricing, routing, and destination-chain execution behaved deterministically across chains.

You can see the complexity of this cross-chain transaction across 3 different explorers.

Tx 1: https://arbiscan.io/tx/0xacd42cf8599594d29a067b6acaa5020a44014419054ff25dfc8fe508f2740845

LZ Message: https://layerzeroscan.com/tx/0xacd42cf8599594d29a067b6acaa5020a44014419054ff25dfc8fe508f2740845

Tx 2: https://hyperevmscan.io/tx/0x7a5bcd1cdb441a92fb66a2a865177587538165e3448a1a2fa84226c0238f1c35

The most complex path appears on Arbitrum, preparing the Shortcut to execute via LayerZero to arrive on HyperEVM finally.

HyperSwap’s own pool executed the swap on arrival.

$HYPE delivered to the user.

Impact

- Time to market: 5 days instead of 8–12 months.

- Execution time: ~16 seconds end-to-end.

- Gas: ~$0.15 across both chains.

- Success rate: 99.9%+.

- Execution quality: deterministic outcomes across chains, even for high-value trades.

- User flow: one click, one signature, best available pricing.

HyperSwap’s pools are now part of Enso’s global routing network, automatically receiving flow from cross-chain swaps.

“At Enso we enjoy working with teams like Hyperswap who put their users first in all regards such as: security, usability and best execution. Enso makes this a reality, and ensures the best service for all partners.” — Connor Howe, CEO and Co-founder, Enso.

What It Unlocks

With cross-chain infrastructure solved, HyperSwap can focus on innovation:Needs smarter routing, intent-based interfaces, gasless transactions, and deeper liquidity strategies across the HyperEVM ecosystem.

By guaranteeing simulation-backed, deterministic execution across chains, Enso enables HyperSwap to confidently attract and retain liquidity from multiple ecosystems, turning execution quality into a durable growth lever.

“Integrating Enso was a turning point. We replaced months of complexity with a unified engine we can trust.” — https://x.com/0xRyzed, Hyperswap CEO

Questions? Contact our team to discuss your integration.