Kodiak Powers Permissionless Auto-Compounding Vaults with Enso

Kodiak’s Vaults, better known as 'Baults', are ERC-4626 vaults, which are smart contracts that standardize the process of depositing and withdrawing tokens while earning yield on the underlying asset. Under the hood, these vaults stake user deposits into Berachain’s native Proof-of-Liquidity (PoL) reward vaults. The vaults earn BGT incentives, which are then claimed, swapped into more LP tokens, and restaked, compounding the yield.

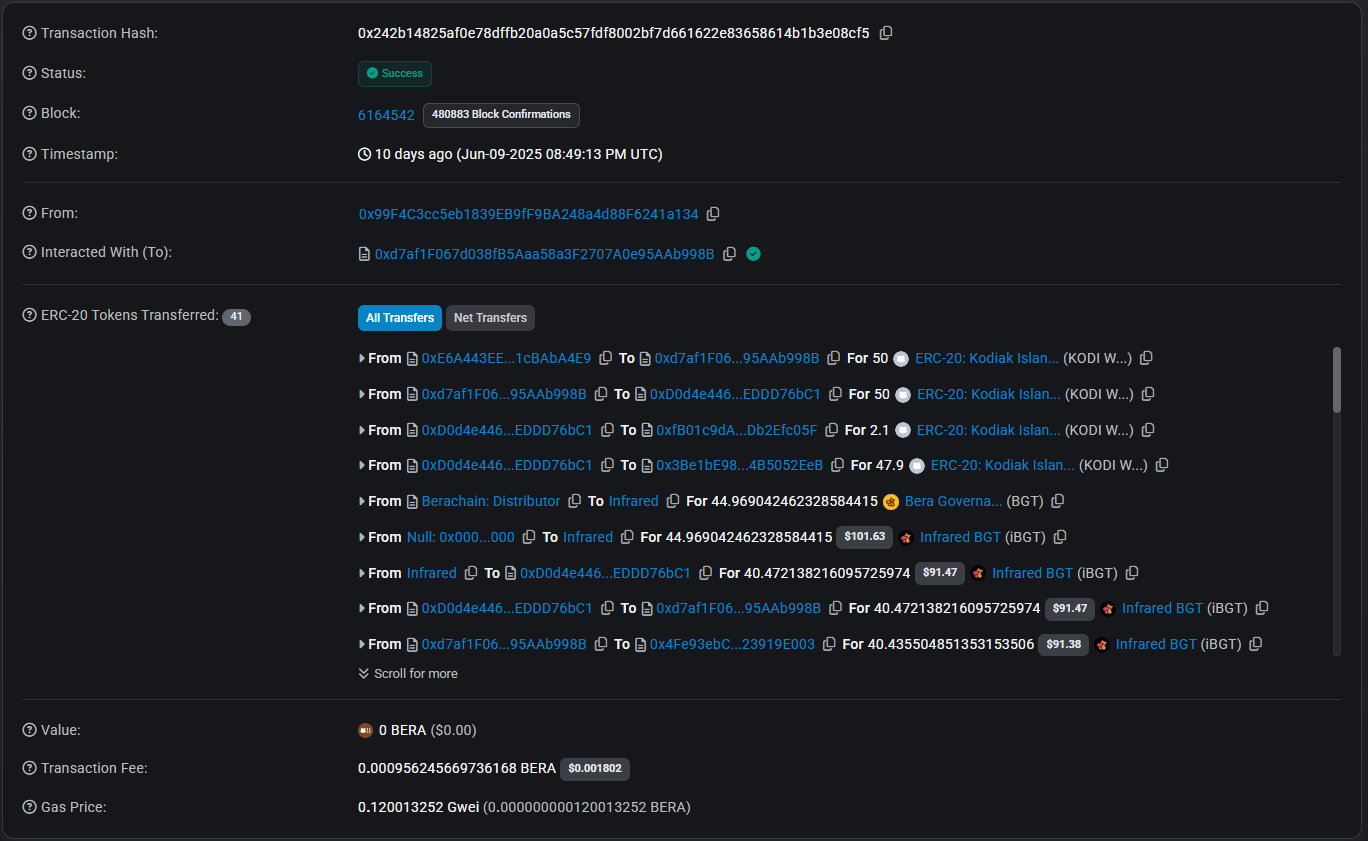

To stay efficient, these vaults use bots, also called Keepers, that harvest rewards, swap them, and reinvest in a single transaction. But the key to making that flow efficient isn’t just the bot logic; it’s the infrastructure they rely on.

Behind the scenes, Kodiak’s bots use the Enso API to:

• Route BGT rewards through the best swap paths

• Bundle swaps and deposits into one atomic call

• Execute compounding onchain, automatically and at scale

Automating the Loop

If done manually, this process requires users to actively monitor rewards, choose the highest-yielding BGT wrapper (like iBGT, LBGT, or yBGT), execute a swap, and restake their tokens. It’s tedious and inefficient.

So Kodiak automated the process, but instead of centralizing it, they made it open.

Every Bault operates on a permissionless bounty system. Anyone can trigger compounding as long as they pay a small bounty. This bounty is denominated in the vault’s underlying LP token and becomes the economic incentive for bots or users to run the compounding logic at the right time.

The Keeper System

When a Bault accrues enough BGT rewards, a compounding opportunity appears.

A Keeper monitors this balance. Once the value of the unclaimed rewards exceeds the bounty amount, it executes a transaction that claims the BGT rewards, wraps them into the most profitable liquid BGT token, and converts them into more LP tokens. These LP tokens are then deposited back into the vault. The keeper earns the rewards, minus a small fee, and the vault continues to grow.

But executing this process efficiently, across different routes and wrappers, requires infrastructure. It means calculating optimal paths, accessing liquidity, minimizing slippage, and wrapping or unwrapping tokens across protocols.

This is where Enso comes in.

Enso Handles the Execution

Kodiak’s keeper bot uses the Enso API to run the backend of every compound.

Instead of hardcoding swaps or relying on a single DEX router, the bot calls Enso to dynamically compute the best swap route, from the chosen BGT wrapper to the vault’s LP token. This route might involve multiple hops, liquidity sources, and protocols on Berachain. Enso abstracts that complexity and returns a route ready for execution.

The keeper bot then uses this route to perform the swap and finalize the compound. The entire strategy, claim, wrap, convert, restake, is encoded and executed via Enso.

This modular approach allows Kodiak, and other Keepers to maintain a simple vault interface while relying on Enso’s infrastructure to handle the heavy lifting.

Why Choose Enso For Your Keeper

Enso’s API made it easy for anyone to integrate advanced execution into a system designed for openness.

Rather than writing custom compounding logic for each vault or managing liquidity paths manually, they rely on Enso’s routing engine. It’s fast, efficient, and already compatible with Berachain-native assets. By using Enso, Kodiak opened the door for any developer, or any bot, to participate in compounding and earn yield, all while keeping the core vault contracts clean and secure.

Kodiak’s approach is a blueprint for building permissionless auto-compounding. Anyone can create a Keeper with the Enso API and jump into the competition for auto-compounding rewards.

If you want to build your own Keeper, read this documentation.

→ Kodiak's compounding documentation

→ Enso API