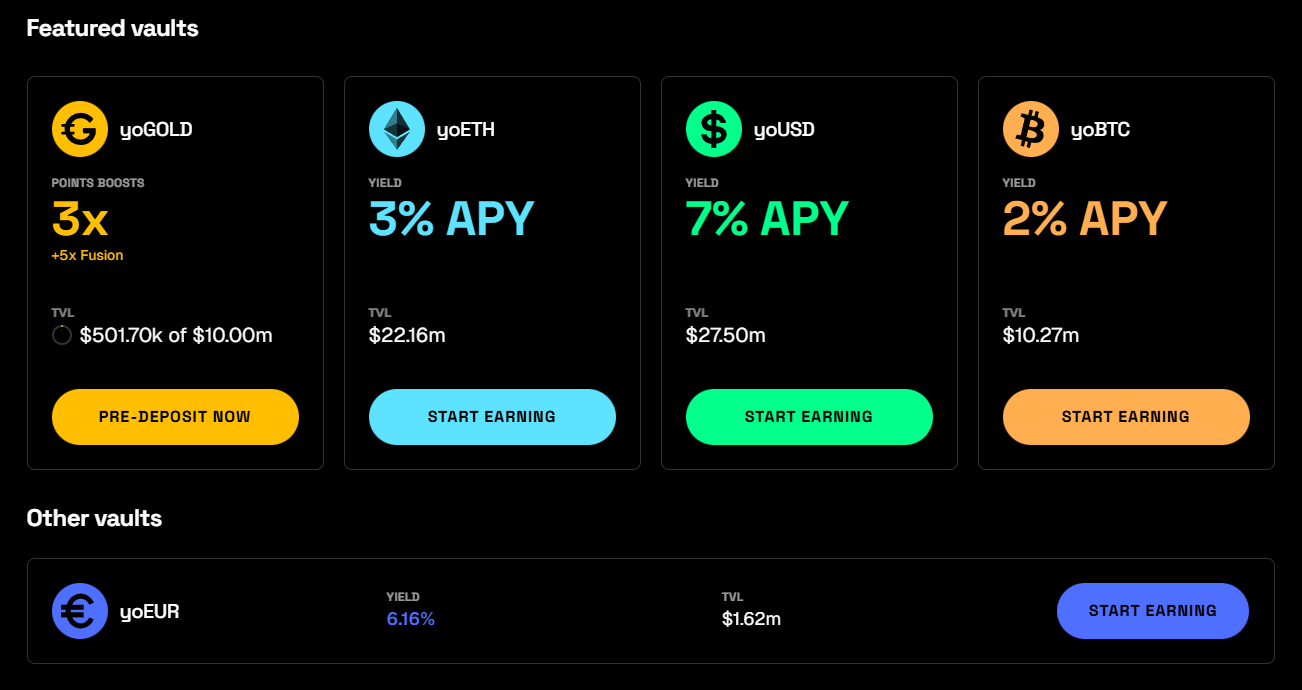

How YO Built Institutional-Grade Onchain Asset Allocation

Asset management onchain is defined by execution quality as much as by strategy logic. Yo’s architecture reflects that reality: capital must flow in from across different networks, and once inside, rebalancing must happen reliably, predictably, and at scale.

Achieving this required not just composable smart contracts, but an execution infrastructure capable of deterministic simulation, unified cross-protocol routing, and consistent abstraction, which is why Yo chose Enso as core infrastructure.

Cross-Chain Onboarding That Removes Barriers

Yo’s vaults are deployed on Base, yet users manage capital across multiple chains. Rather than forcing users to bridge and swap manually, Yo uses Enso to abstract cross-chain onboarding into a single zap flow. This eliminates a major adoption barrier, broadens the addressable market, and keeps friction low for sophisticated allocators who regularly rebalance across ecosystems.

Execution as Decision Infrastructure

Once capital is inside a vault, the system must shift from routing to management. Yo’s users care about where capital is deployed, how often positions change, and whether outcomes are predictable. That is where Enso’s execution and simulation layer becomes core operational infrastructure.

Each complex operation is fully simulated end-to-end before execution. Enso produces deterministic call data that reflects exactly what will happen onchain, removing guesswork and reinforcing predictability even under real volume.

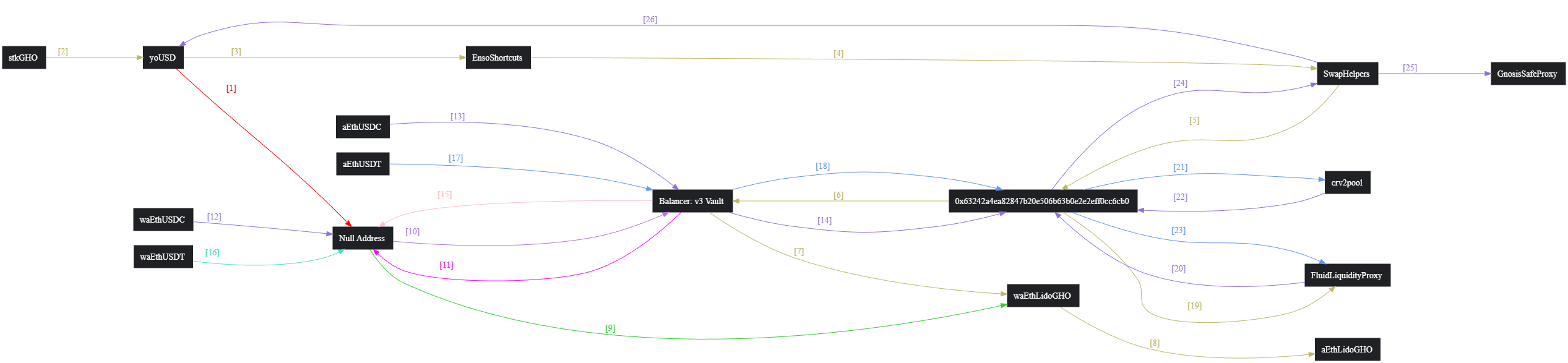

A Real Example: Asset Rebalancing in Practice

To illustrate how this works in practice, let's analyze this transaction: https://etherscan.io/tx/0xc771534d300876af432de5a043f71d7c5a5d903d8bcfd0e72392f30e1c2b2363

The trace shows dozens of ERC-20 token transfers and several protocols such as Balancer, Aave, KyberSwap, all bundled into a single execution path that resulted in a coherent rebalance without intermediate failed transactions.

This kind of outcome, is only possible when the infrastructure layer can:

- Simulate every step in advance,

- Generate deterministic calldata that anticipates all state changes,

- Route actions through the appropriate protocol endpoints without fragmentation, and

- Execute them atomically to avoid partial failures.

Active Asset Allocation Without Fragility

Once this execution infrastructure is in place, Yo can build dynamic strategies that:

- Allocate capital across venues based on risk/return insights.

- Rebalance exposures when market conditions shift.

- Capture structural inefficiencies like arbitrage opportunities.

- Shift positions across chains without manual user intervention.

Crucially, as strategy complexity increases (more chains, more venues, higher rebalance frequency), the system does not become proportionally more brittle. Enso’s standardized execution and pre-execution simulation mean Yo can scale sophistication without scaling operational rubble.

Collaboration That Extends Beyond Integration

Rather than merely plugging in an SDK or API, both teams jointly design composable strategy bundles and explore execution patterns that would otherwise be costly and brittle to develop internally. That shared work accelerates Yo’s ability to deliver actively managed products that are not only sophisticated in concept but reliable in execution.

Operating With Financial-Grade Discipline

Beyond execution, Enso supports operational surfaces that real financial products depend on: price and TVL endpoints for monitoring, consistent accounting and tracking interfaces, and auditable execution flows that integrate cleanly with governance and reporting layers.

By unifying Yo’s strategy logic with Enso’s execution, simulation, routing, and cross-chain mechanics, the app now enables:

- Seamless onboarding from other chains.

- Deterministic, auditable execution.

- Dynamic asset allocation across multiple ecosystems.

- Scaling complexity without fragility.

This combination is precisely what sophisticated allocators (from power users to emerging institutions) prioritize when choosing onchain asset management solutions.