Migrating your Uniswap LP’s to Uniswap v4

Uniswap LP Migration, Simplified.

Uniswap v4 brings one of the most significant evolutions in automated market making since the launch of v3. With it comes a new level of precision, customization, and capital efficiency for liquidity providers. But there’s a catch: getting your liquidity into v4, especially across multiple chains, has been anything but simple.

Until now.

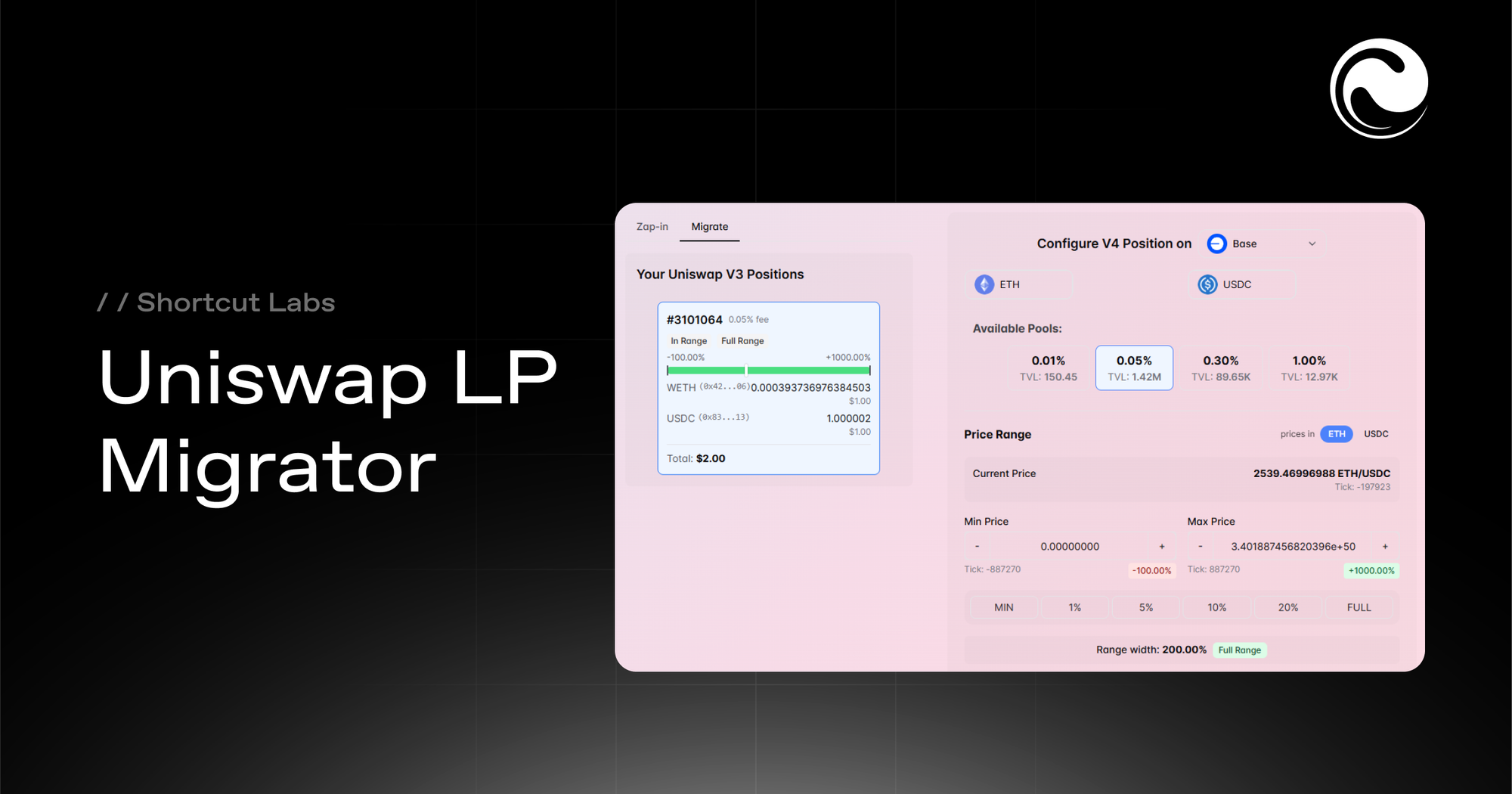

Today, we’re taking a closer look at the Uniswap LP Migrator, a crosschain application powered by Enso, LayerZero, and Stargate that’s already live and in use. It lets you migrate your Uniswap v2 or v3 positions into Uniswap v4 across Ethereum mainnet, Optimism, Arbitrum, Base, and Unichain, with no need to manually bridge, withdraw, or configure ranges.

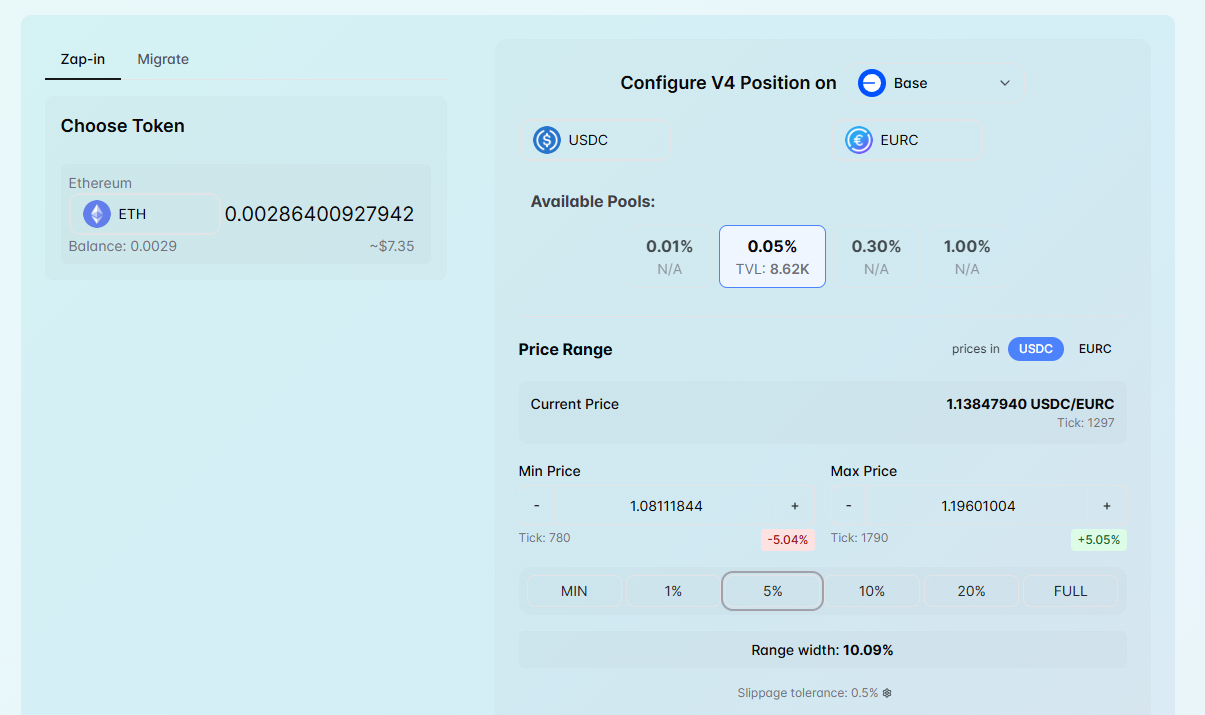

But it’s not just for migrations. The Migrator also supports zap-ins, making it easy to set up a new Uniswap v4 LP position from scratch—even if your funds are on a different chain.

If you’re looking to migrate to Uniswap v4 and aren’t sure where to start, this blog breaks it all down:

- What’s different about Uniswap v4

- How ticks and ranges work

- And how the Uniswap LP Migrator turns it all into a one-click flow

Why Migration Has Been Hard

While v3 introduced the concept of concentrated liquidity, v4 builds on that with greater flexibility through custom logic (“hooks”), singleton architecture for gas efficiency, and dynamic fee tiers.

But the core shift for LPs remains the same: you no longer provide liquidity across an entire price curve, but instead within a defined price range, using ticks.

This new structure demands a better understanding from LPs, and until recently, the migration process involved multiple error-prone steps:

- Withdrawing LP tokens from your original v2 or v3 pool

- Swapping assets into the correct token pair

- Bridging funds manually across chains

- Rebuilding your liquidity position manually using Uniswap v4’s interface

- Choosing the correct tick range and deploying

Each step created an opportunity for mistakes, inefficiencies, or user drop-off.

The Uniswap LP Migrator was built to abstract all that behind one simple experience.

Let’s Talk About Ticks and Ranges

To understand why the Migrator is so useful, we need to talk about the mechanics of Uniswap v4 — specifically, how tick and ranges work.

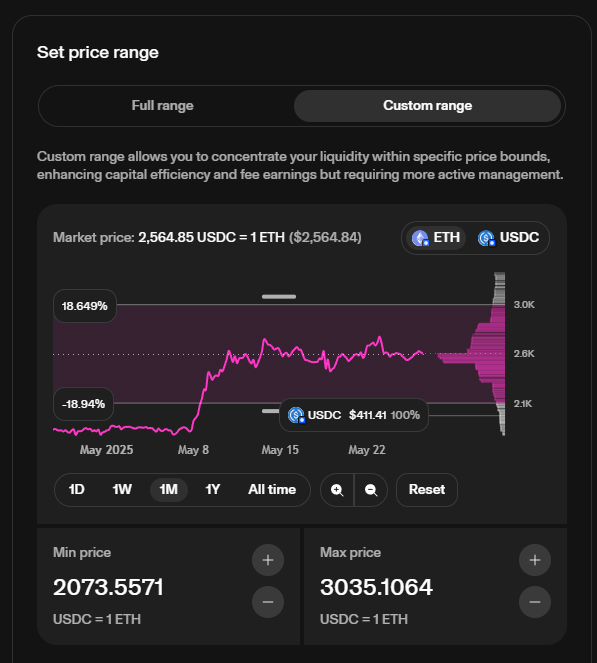

Unlike v2 (where liquidity was deployed across the entire price curve), or even v3 (where LPs could define fixed price ranges), v4 gives liquidity providers even more granular control.

What is a Tick?

A tick is a discrete price point in Uniswap’s system. Think of the price curve as a staircase: each tick is a step. When you define a range, you select the “start step” and the “end step” where your liquidity will be active.

The advantage? You’re not wasting capital across unused parts of the curve. You can choose to provide liquidity only where trading is most likely to happen, which means higher fees and better capital efficiency.

Example:

Imagine you’re providing liquidity to the ETH/USDC pair.

- If ETH is currently $2,600, you might choose to concentrate liquidity between $2,700 and $2,500.

- That means your liquidity will only be active when ETH is within that price range, but you’ll earn much more from each trade compared to a full-range position.

Of course, this comes with a trade-off: if the price moves outside your range, you stop earning fees. That’s why choosing the right tick range is a balancing act between efficiency and uptime.

The Migrator UI helps with this by offering default ranges, or, if you’re a more advanced LP, you can customize your tick range manually.

Abstracting Bridging, Swapping, and LP’ing

Here’s where the magic happens. Most LPs understand the friction of cross-chain DeFi:

You must bridge tokens, swap assets to match a pool, configure positions manually, and then pay for transactions on both chains. That’s at least half a dozen steps, assuming nothing goes wrong.

The Uniswap LP Migrator abstracts all of this.

You start with your existing LP position on any EVM chain: Ethereum mainnet, Arbitrum, Base, Optimism, or Unichain. The migrator reads your LP tokens, withdraws the underlying assets, swaps them if necessary to match the v4 pool you’re targeting, bridges them using Stargate, and builds a new LP position on Uniswap v4, all in one atomic transaction.

Uniswap LP Migrator

You don’t have to leave the UI. You don’t have to touch a bridge. You don’t even have to understand how Stargate or LayerZero works. It just works.

This is the whole point of blockchain shortcuts: executing complex, multi-protocol workflows with minimal user effort, while preserving full composability behind the scenes.

Why It Works

The LP Migrator is powered by a collaboration between:

- Enso, which handles the logic, execution, and interface to abstract everything into a single workflow

- LayerZero, which enables low-level, secure cross-chain communication between different EVM environments

- Stargate, which transports liquidity across chains with unified asset routing and guaranteed finality

Together, they remove the need for dApp-hopping, bridging interfaces, or custom deployment logic. You just click, and the migrator takes care of the rest.

Real Results. Real Usage.

The tool is already live and has processed multiple LP migrations across Ethereum, Base, and beyond.

Try it yourself: https://migrate.enso.build

Are you looking to integrate the Uniswap LP Migrator into your own app or frontend?

You can. The Uniswap LP Migrator is a plug-and-play React component fully compatible with wagmi and RainbowKit. Customize the template, drop it into your UI, and you're ready. No need to build complex flows from scratch.

Start integrating: https://docs.enso.build/pages/templates/unichain-migrator