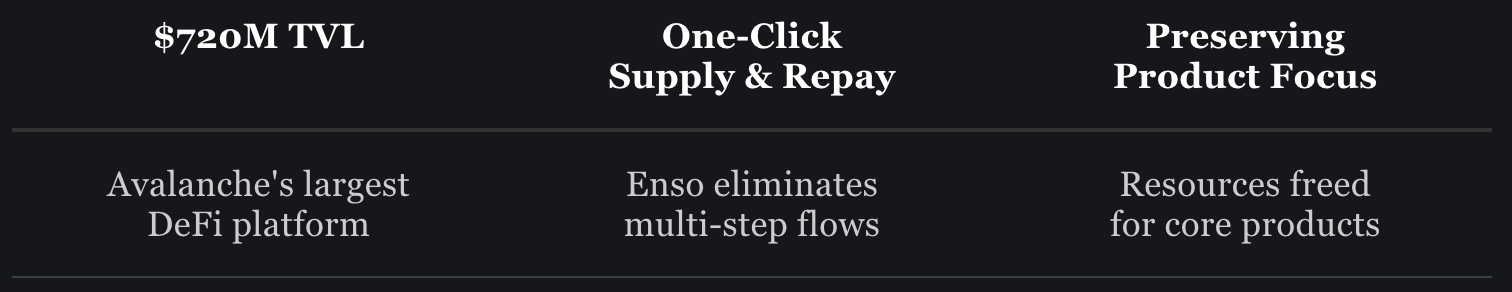

One-Click Lending: How Benqi Cut Through The Multi-Step DeFi Problem

Benqi eliminated the back-and-forth between DEXs and lending protocols by providing one-click lending shortcuts to users using Enso’s crosschain declarative routing.

Having a protocol present on a single chain and being accessible from multiple chains sounds like an oxymoron—an “either/or” situation the Benqi team didn’t accept. Instead of deploying on several chains and paying the cost of ops and maintenance, Benqi found the “have your cake and eat it too” solution.

The decision to stay exclusively on Avalanche would have created UX and potential engagement issues: users would need to jump between several platforms, especially if they wanted to deposit to Benqi from other chains. The ingredient that enabled crosschain shortcuts to their users is Enso’s routing API.

Besides being the largest DeFi hub on Avalanche, the team has three additional products: liquid staking (sAVAX), validator bootstrapping (Ignite), and node voting. For the team, every product decision must be sustainable in the long run. As Dan Mgbor, Benqi's founder, explains:

"After searching for a solution for two and a half years, we knew we'd never justify the development. We would never build it ourselves."

The Platform-Hopping Problem

The Benqi team observed a consistent pattern: users were leaving their platform to complete basic transactions before returning to deposit assets or repay loans.

The typical user journey looked like this:

- User wants to supply wrapped ETH but only holds AVAX

- Navigate to Trader Joe or Pangolin DEX

- Connect wallet and perform swap

- Return to Benqi to supply the asset

- Multiple transaction fees and potential slippage

This became critical during market volatility! Users needing to repay loans quickly faced the same multi-step process when they needed speed most to avoid liquidation.

The team also noticed users consistently moving between liquid staking and lending. As Dan concluded:

"It was important for us to have a platform that makes that experience seamless."

One Platform, All Chains

Benqi had two options: launch fragmented instances across different chains or find a way to bring all users to their optimized Avalanche environment.

Instead of compromising on the fast finality and user experience that defined their platform, Benqi chose to maintain their Avalanche focus while making their platform accessible to users with assets on any chain. This preserved their competitive advantages while solving the complexity users faced.

Enso's crosschain routing API solved both the user experience problem and the development resource constraint. The integration focused on the highest-impact areas: supply and repay flows for lending products.

Implementation covered:

- Supply any asset: Users can supply any token to any lending market in one transaction.

- Repay directly with any token: Users can repay loans with any token they hold at a given moment, which is critical for liquidation protection.

- Liquid staking integration: Direct paths from any token on any chain to sAVAX deposits.

The user experience became simple: select the asset you want to supply or the loan you want to repay, choose which token to use from your wallet, and execute in one transaction.

Results, Beyond UX

The integration delivered improvements while solving the resource allocation problem for the team.

- Eliminated platform switching for basic operations

- Reduced time-to-execution during critical market moments

- Simplified onboarding for users unfamiliar with DeFi workflows

- Enabled team to prioritize core value over solving routing

- Slashed weeks of complex integration and maintenance work

- Maintained velocity while improving UX

These results offer broader lessons for DeFi teams facing similar challenges.

Key Takeaways

Benqi demonstrates how routing infrastructure enables teams to focus on core innovation while delivering seamless user experiences, without making compromises about core product values and principles.

- User behavior reveals priorities. Gathering insights about where users go before and after using your platform shows which shortcuts matter most.

- User experience in crisis moments is crucial. The highest-value integrations eliminate friction during time-sensitive situations like potential liquidations.

- Resource constraints drive decisions. Teams managing multiple products need solutions that eliminate entire development workstreams.

- Focus preserves competitive advantage. Use infrastructure solutions to maintain core strengths while expanding accessibility.

Sometimes the smartest product decision is recognizing what you shouldn't build internally, freeing your team to focus on what makes your platform unique while shortcuts handle the complexity.

Cut through poor DeFi experience with Enso's /route API for crosschain asset routing, or explore /bundle for blueprinting complex multi-protocol workflows. Start building now!