Powering Boyco: Enso’s Role in Berachain's Launch

With the rollover event, the Boyco initiative concluded its final phase on May 6th, completing a multi-stage migration effort into Berachain’s new ecosystem. From enabling the initial $3.1B migration to now the rollover, Enso provided the infrastructure that enabled a smooth, one-click experience across chains.

A 3.1B Initial Bootstrapping

Building a new network ecosystem can take years to become popular and reach deep liquidity, making ecosystem apps usable. Berachain and Royco changed this model through the Boyco initiative, a liquidity bootstrapping approach built on Royco's Cross-Chain Deposit Module (CCDM) and powered by Enso's shortcuts.

The solution came through a powerful combination of three key players:

- Royco provided the CCDM structure, allowing protocols to incentivize users to commit assets on a source chain for specific actions on a destination chain.

- Enso provided the infrastructure for automated execution across protocols.

- LayerZero and Stargate enabled safe bridging of liquidity from Ethereum mainnet to Berachain.

This collaboration created a new standard for network launches that unfolded in two phases:

The $3.1B DeFi Migration: Enso-powered architecture enabled the largest DeFi migration in blockchain history three months ago. More than $3.1 billion in assets flowed from different networks to Berachain, with LayerZero and Stargate facilitating secure cross-chain bridging and Enso shortcuts handling the protocol-level execution. In total, 84 shortcuts were triggered, ranging from small transactions to single flows moving over $300 million in assets.

The May 6th Rollover: Now, the ecosystem enters its mature stage with the rollover event. Users claiming BERA can transfer funds from Royco to Berachain reward vaults with just one click.

Inside the May 6th Rollover

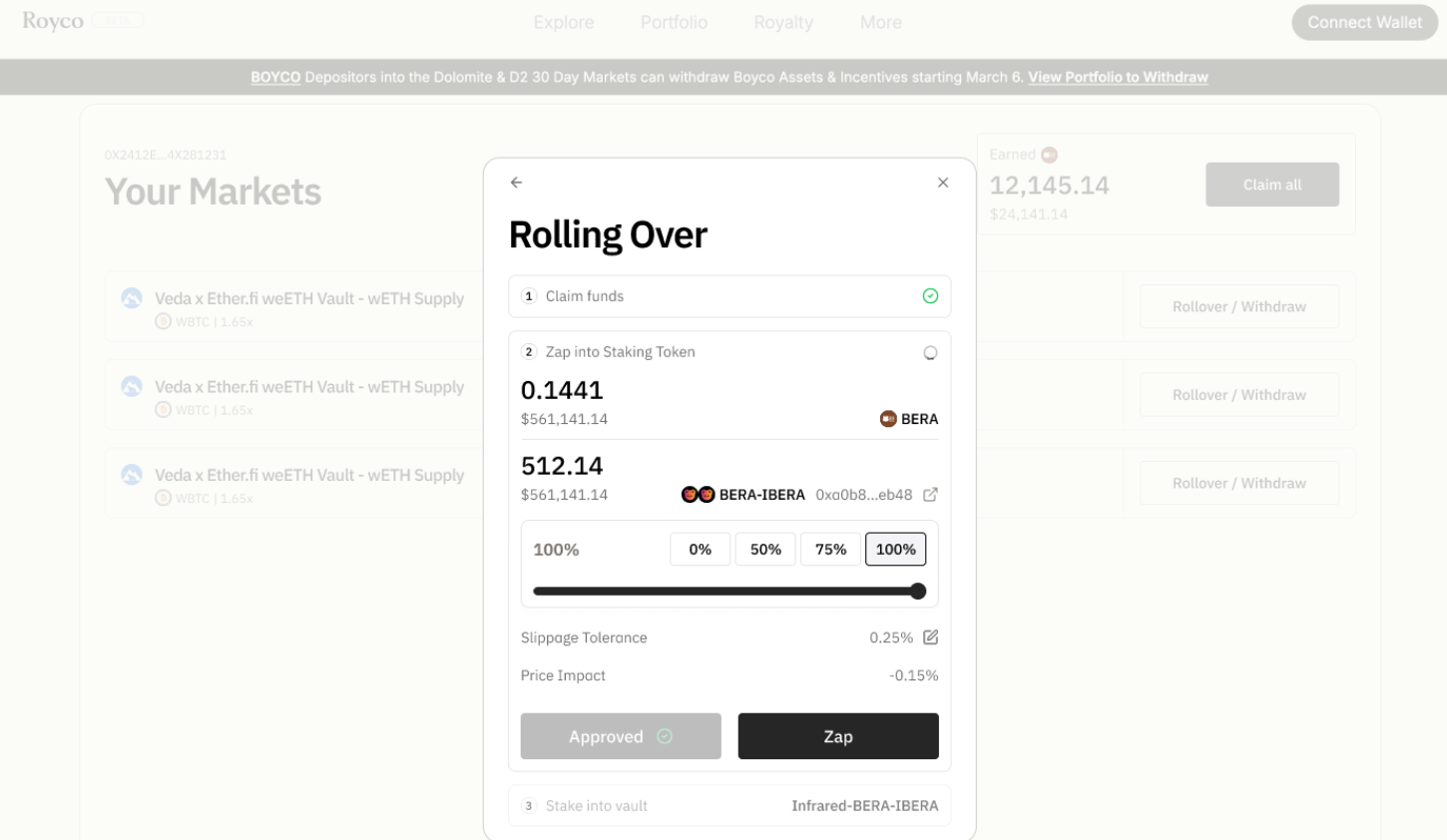

The Boyco rollover went live on May 6th as the final step in Berachain’s migration process. As users claimed their BERA tokens, they were prompted to reposition their assets by migrating LPs, redeeming vaults, or reallocating to new strategies. Enso’s infrastructure enabled this phase: powering the underlying logic that allowed protocols to present these complex actions as simple, one-click rollovers to their users, and simplifying the development process to their teams.

The rollover process allowed users to transfer funds from Boyco directly into Berachain reward vaults (whitelisted on BeraHub) through a one-click experience. Behind this simple interface, Enso shortcuts handled complex operations:

- Swaps: Converting between different asset types with optimal routing

- LP Creation: Establishing liquidity positions across protocols

- Redemptions: Processing withdrawal and reinvestment flows

- APY Calculations: Real-time yield assessments across vaults

- Token Data: Managing asset metadata across the ecosystem

If a selected vault requires different underlying assets, Enso shortcuts automatically handle the conversion process. This eliminates the traditional multi-step process that would require users to:

- Withdraw and exit the app.

- Find a Dex.

- Approve tokens for exchange.

- Execute the swap.

- Return to the original app.

- Approve the new tokens.

- Finally, complete their deposit.

What once required a complex, error-prone, 7-step workflow is now abstracted into a single, reliable shortcut; making advanced strategies easier and safer for users. Once completed, users could immediately stake their receipt tokens in reward vaults or on Infrared to earn APR, BGT (iBGT), and additional yield.

A New Paradigm for Future Chain Launches

As Berachain's ecosystem matures following the May 6th rollover, the blueprint created through this collaboration offers a powerful model for future chain launches. The combination of Royco's CCDM, Enso's shortcuts, and LayerZero bridging provides a repeatable pattern that could transform how new ecosystems bootstrap liquidity.

For projects looking to launch new chains, the path is now clear:

- Create a structured incentive marketplace that allows protocols and users to negotiate fair rewards

- Leverage infrastructure shortcuts to automate complex operations and reduce technical barriers

- Ensure secure bridging of liquidity from established chains to new ecosystems

This model compresses what would traditionally be years of organic growth into a structured, efficient process measured in months. As protocols create new chains that emerge to serve specific use cases, the ability to bootstrap liquidity quickly will become increasingly valuable.

The next generation of chain launches has a clear template: build on proven infrastructure, create transparent incentive mechanisms, and remove technical friction through shortcuts.