The Engine Behind Web3

Let's be honest, Web3 is growing rapidly, but building in it remains challenging. But for builders, the challenge hasn’t changed: making it all work together.

Yes, we've got an expanding ecosystem: DeFi vaults, AI agents, Telegram bots, Bitcoin-native strategies. However, under the hood, most teams still struggle with the same issue: integrating all these components to work together effectively.

Every promising product idea faces the same reality: fragmented protocols, too many chains, and complex backend logic. As a builder, you’re forced to wire everything together from scratch. That means weeks of custom code, costly audits, endless trial and error, burning time, budget, and momentum. The result? A slower go-to-market and a stack that’s hard to maintain.

That’s where Enso comes in, powering not just all major categories that make up Web3, but the builders behind them. Behind every vault, bot, loop, and agent, there’s a distinct kind of builder and a Shortcut making it run.

What is Enso?

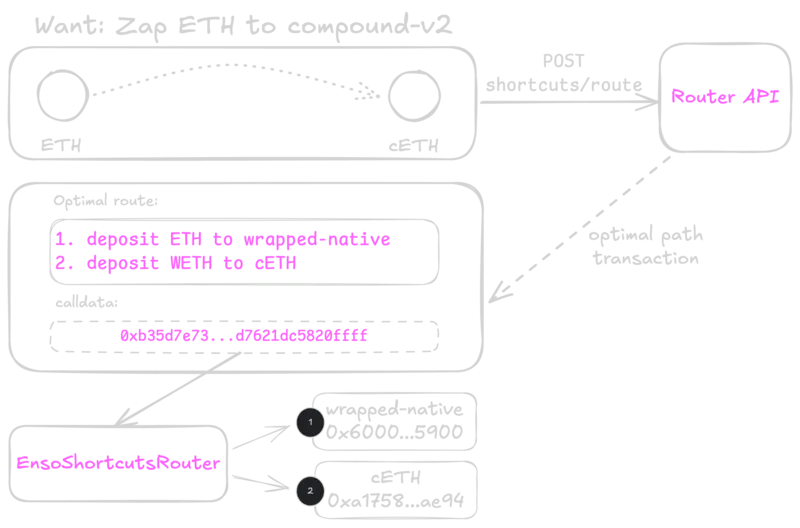

Enso is the execution engine for onchain apps. It's the connecting layer that allows developers to combine protocols, chains, and actions, without building custom infrastructure every time.

At its core, we find Enso Shortcuts: modular, reusable paths that abstract multi-step logic into a single call. Lending, swapping, rebalancing, looping; all the stuff that usually takes weeks of integration can now happen on your product in one transaction.

For developers, this changes everything:

- Simplified backend architecture.

- Reusable protocol integrations.

- Just plug in, build fast, and ship.

For users, it means applications with cleaner interfaces and more reliable performance, products that work intuitively and efficiently.

Powering Every Builder

Enso is live, proven, and battle-tested.

We’ve integrated over 200 protocols across chains, powering the backend for 75+ onchain apps in production. Over $15 billion in transaction volume has been enabled through Enso without a single dollar lost.

Builders are using Enso to simplify architecture, go to market faster, and unlock entirely new categories of products.

Here’s how it fits across the ecosystem’s most critical verticals:

DeFi Infrastructure

From vaults and stablecoins to LRT strategies and DEX routing, Enso makes DeFi programmable and modular.

Powering: Dinero, Reservoir, Level USD, Stablejack, Kodiak.

BTCFi

Bitcoin-native DeFi is booming, but its composability is hard. Enso bridges that gap with Bitcoin shortcuts that integrate cleanly with the rest of the ecosystem.

Powering: Bedrock, Solv, Stakestone, Lorenzo, pumpBTC.

AI x DeFi (DeFAI)

AI agents need more than data; they need execution. Enso enables agents to manage assets, move liquidity, and react on-chain in real-time.

Powering: Wayfinder, Loomlay, HeyAnon, Virtuals, Brahma.

Automated Asset Management

Vaults, yield frameworks, and cross-chain portfolio tools built on clean logic, not spaghetti code.

Powering: Velvet Capital, Otomato, Yearn, Vaultcraft, YieldNest.

Backend Automation

What used to be hardcoded and brittle is now flexible and composable: flash loan looping strategies, liquidation bots, rebalancers, and more.

Powering: Contango, Silo, Beraborrow, Euler.

Telegram Bots

Trading is becoming social. Enso handles the backend logic for bots that execute real flows through chat interfaces.

Powering: Shogun, Grindery, Berabot.

RWA

Real-world asset protocols need perfect execution across chains and their DeFi primitives. Enso simplifies everything from swaps to yield deployment with composable shortcuts.

Powering: Coinshift, Plume.

Enso Is Quietly Powering the Future

Every tech wave has its invisible layer, that infrastructure stack that makes everything else move faster.

Linux. AWS. Stripe, and now Enso.

If you're ready to go down the rabbit hole and start building onchain, dive into our docs and let Enso handle the rest.

Over the next few days, we’ll take a closer look at the builders Enso powers, one category at a time.