YieldNest’s Capital-First Approach to Multichain Expansion

YieldNest builds yield-bearing assets for capital seeking stability. Products like ynRWAx give users exposure to real-world yields backed by off-chain collateral, diversified across durations and managed through fully audited, onchain infrastructure. YieldNest also issues LST-style assets such as ynBNB, applying the same execution standards to crypto-native markets.

For products that represent real-world value, execution quality is a must-have for large allocators who care less about novelty and more about certainty. They want to know that when capital moves, it lands exactly where expected, at the expected price, every time.

The Real Cost of Multichain Expansion

Every new chain creates pressure on protocols to “be there.” In practice, this usually means:

- Deploying and maintaining new contracts

- Seeding and managing DEX liquidity

- Monitoring fragmented risk surfaces

- Supporting infrastructure that may only remain relevant for a few months

The reality is that many new chains have short lifespans. After the initial hype, what’s left behind are dormant contracts, stranded liquidity, and long-tail operational risk.

The Structural Problem with Crosschain Minting

YieldNest chose to keep minting, accounting, and risk management on only a few home chains, where liquidity and controls are strongest. To support users coming from new and emerging chains, YieldNest integrated Enso API and bundling solutions for capital-efficient multichain access. The usual solution is to ask them to swap and bridge, step by step, manually.

That approach does not scale. Each hop introduces slippage, price impact, timing risk, and opaque failure modes. For larger positions, this is unacceptable. Fragmented liquidity and best-effort execution erode trust long before they cause visible losses.

Before Enso users would have to use other apps to swap and/or bridge for a deposit asset accepted by the selected vault they wanted to use if they did not not have that token on the correct chain. - @yieldsensei - Co-founder & CPO, YieldNest

YieldNest needed a way to accept capital from any chain while preserving a single, efficient mint, without exposing users to market impact or bridge risk.

Deterministic Cross-Chain Minting

Enso enables one-click cross-chain minting by executing the full mint lifecycle as a single, atomic transaction. Capital can originate on any chain, route through the necessary swaps and bridges, mint on the canonical chain where liquidity lives, and return to the user’s preferred chain, all in one execution.

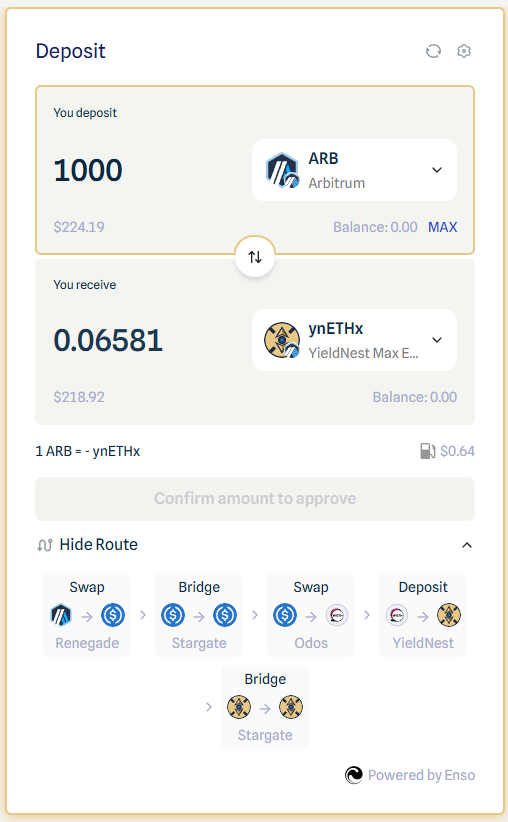

With Enso, the entire flow is abstracted into a single execution:

- The user deposits on a new chain

- Capital is bridged to YieldNest’s home chain

- The deposit is executed into the YieldNest contract

- YieldNest tokens are minted/swapped to

- The new tokens are bridged back to the user’s original chain

From the user’s perspective, this feels like a local mint/swap.

From YieldNest’s perspective, nothing new needs to be deployed.

What matters more than crosschain expansion is that the outcome is deterministic. All steps are simulated upfront. Fees, routing, and execution paths are known before the transaction is signed. If any part fails, nothing settles.

There is no partial execution, no silent slippage, and no price impact from fragmented liquidity. Large positions mint at the intended rate, every time.

Why This Matters for Large Capital Allocators

For large allocators, the primary risk in DeFi is execution uncertainty.

Enso removes that uncertainty by letting allocators and protocols concentrate liquidity where it is most efficient while still offering cross-chain access. Users tap into primary liquidity directly rather than relying on secondary-market depth across multiple chains. This avoids slippage and price impact while preserving the mint's integrity.

From the user’s perspective, there is no bridge to manage and no sequencing risk to reason about. From the protocol’s perspective, capital flows remain predictable and auditable.

This is the only way to mint RWA-backed assets and LSTs at scale without compromising on security or reliability.

A New Baseline for Multichain Asset Issuance

YieldNest’s integration with Enso establishes a new default:

Keep issuance canonical. Make access universal.

The benefits compound:

- Zero marginal contract risk on new chains

- No capital fragmentation across shallow pools

- No long-term maintenance burden for chains that fade

- Faster go-to-market on emerging ecosystems

For protocols issuing yield-bearing assets, RWAs, or LSTs, this matters far more than raw chain count.

For protocols building yield products, RWAs, or LSTs, this approach preserves execution quality while eliminating the operational drag of constant redeployment.

This is how serious assets scale across chains, without inheriting their fragility.